Ato Company Tax Return

ATO Community is here to help make tax and super easier. On 1 July 2021.

Example Case Study 2 Australian Taxation Office

Has an aggregated turnover less than 50 million from 20182019 25 million for 2017 2018.

Ato company tax return. If you are a sole trader partnership trust or company you have a choice in how to lodge your tax return. Hi lmorris You can lodge your company tax return online through Standard Business Reporting SBR software. Check they are registered with the Tax Practitioners Board online with myTax if youre a sole trader.

Depreciation Summary for Company Tax Return Form CTR Reporting Partnership Interest Trust. You may be able to lodge online using. Tips for lodging your tax return.

If youre a director youll still need to lodge your own personal return as well. You must lodge a company tax return and pay tax on the companys income. Every registered Australian company must lodge a company tax return each year.

Trust A trust has its own TFN and must lodge a trust income tax return. Hello I have registered for a PTY LTD company on 1st March 2020. Recording of tax refund credit from Company Tax to BAS account.

Take advantage of small business concessions. International dealings schedule IDS Interposed entity election or revocation 2788 IT Client Report ITCRPT 2014 Lodgment. From the 20172018 income year your business is eligible for the lower rate if its a base rate entity.

28 February 2022 in most cases if you run your business as a company. We provide affordable yet profitable ATO company tax return services to a range of businesses. The full company tax rate is 30 and the lower company tax rate is 275.

Forms that are not listed for SBR may be lodged using ELS eg. How do you lodge your tax return. Up to date company tax returns keep you ATO-compliant and help you avoid audits and penalties.

I hope this helps. Usually pays its income tax by instalments through the pay as you go PAYG instalments system. We received a tax credit transfer from Company.

If youre doing your own tax return you need to lodge by. Ask questions share your knowledge and discuss your experiences with us and our Community. 3 No any cash injection that is not derived from sales or business activity is not included or declared in the company tax return.

Fringe Benefits Tax Returns FBT Fund Income Tax Return FITR Fund validation service FVS Get EFTR report service. Income Tax Client Report ITCRPT Individual Income Tax Return IITR Interest and Dividend Deductions schedule. Completing your company tax return filing and paying them on time will let you run your company successfully.

Thats why the ATO put together these 13 tips for getting ready for tax time in 2020. In order to file your tax return your business needs to be registered with the HMRC. Importance of Company Tax Return Lodgement.

Read a summary of. Contact them before 31 October if you havent lodged with them before. Companies that carry forward losses which exceed 1000 to 202122 must also lodge a tax return for 202021 even when no assessable income was derived in 202021.

It is crucial for the future health of your company that you stay on top of your company taxes. Because the 2021 financial year returns have not yet been released youll just need to use a 2020 return and cross out the date listed 2019 and 2020 and replace them with the right years 2020 and 2021 on the form. We received a tax refund via EFT to our bank account for 1152077.

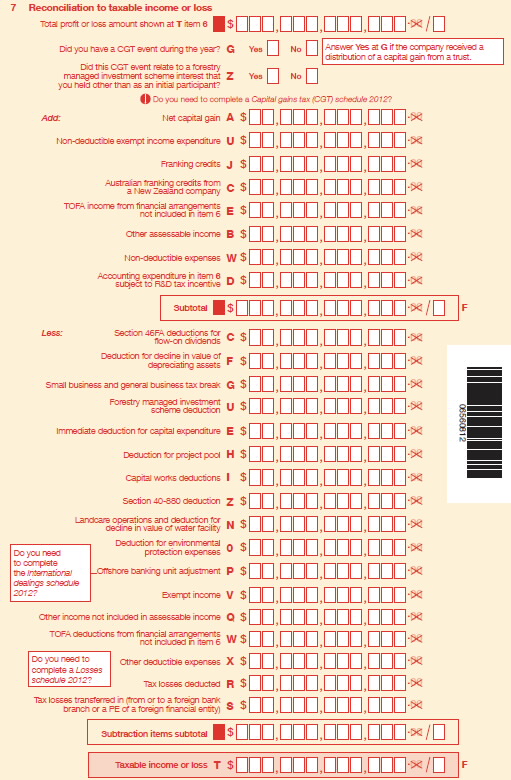

Capital Gains in Company Tax Return CTR Losses - Company Tax Return CTR Company Losses Carried Forward Loss in Company Tax Return CTR. These instructions will help you complete the Company tax return 2020 NAT 0656 the tax return for all companies including head companies of consolidated and multiple entity consolidated MEC groups. 4 Any losses you want to carry forward in future tax returns are not declared in current financial year return.

Most businesses use a tax agent to prepare and lodge returns you can also reach out to them if you need help. Pays tax at the company tax rate or lower company tax rate if a base rate entity may be eligible for small business concessions. You can download the Company tax return 2020 and instructions on our website.

Must pay super guarantee contributions SGC for any eligible workers. If you run a not-for-profit NFP organisation you may be eligible for tax concessions. You can file your companys corporate tax return yourself or get an accountant to prepare and file it for you.

Every company is considered an artificial entity incurred by a set of tax liabilities. Non-profit companies that are resident and have taxable income of 416 or less do not have to lodge a tax return unless specifically requested. Activate Company Tax Return CTR Reporting Module.

You can also file your accounts with Companies House at the same time as your tax return although this isnt currently a requirement. ATO Community Support. A base rate entity is a company that both.

MyTax if youre a sole trader. 31 October if you run your business as a sole trader partnership or trust. I should know how to do this but I keep overthinking it.

MYOB AE and AO Tax 2017 is a Tax Preparation Management and Practitioners Lodgment System PLS packed full of features to help your Practice become more productive and lodge tax returns for the income years 1998 to 2017. That link runs through everything you need to know about setting it. Must lodge an annual company tax return.

To download a PDF copy of the return or order a paper copy through our publication ordering service go to Company tax return 2020. Through a registered tax agent.

Example Case Study 2 Australian Taxation Office

Breaking Fake Ato Phishing Scam Uses Tax Return To Lure Victims

Ato News Research And Analysis The Conversation Page 1

Tax Deductions For Tradies Give Your Refund A Boost

Completing Your Company Tax Return Australian Taxation Office

Completing The Company Tax Return Australian Taxation Office

Breaking Fake Ato Phishing Scam Uses Tax Return To Lure Victims

Company Tax Return Instructions 2012 Australian Taxation Office

Item 3 Status Of Company Australian Taxation Office

Tax Time 2021 Stationery Has Been Released Updated Taxbanter

Company Tax Rates 2021 Atotaxrates Info

Company Loss Carry Back Offset Claims For 2021 Taxbanter

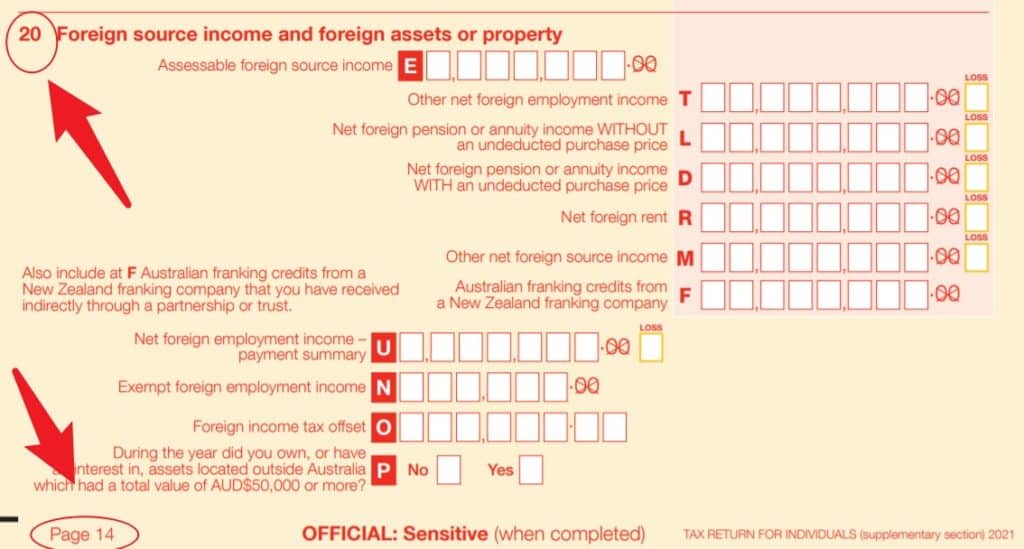

Foreign Income Tax Offset 2021 Atotaxrates Info

Loss Carry Back Offset Company Tax Returns Ps Help Tax Australia 2021 Myob Help Centre

How To Use Your Raiz Annual Tax Statement For Your Tax Return Raiz Invest

Cryptocurrency Taxes In Australia 2020 2021 Guide Cointracker

Post a Comment for "Ato Company Tax Return"