Missouri 529 Tax Deduction

Please visit individual plan websites for additional information. 529 plan tax deductions are offered by 34 states heres the list for 2021 along with states that give breaks for each others plans Lee Huffman 2021-01-13T163756Z.

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

Each state offers at least one 529 plan.

Missouri 529 tax deduction. Educate yourself on your states rules regarding contributions to a 529 plan and keep in mind many states are. 2017 tax year missouri tax forms. Your contribution isnt tax-deductible on your federal return but two-thirds of the states do offer an income-tax deduction for contributions.

Estimate the state tax deduction or credit you could receive for your 529 contribution this year. Under the new law which takes effect Aug. If your state is one of those states that has a 529 plan deduction TurboTax will prompt you to enter your 529 contributions when you get to the creditsdeductions portion of your state tax interview.

Rules for Deducting 529-Plan Contributions About two-thirds of the states offer an income-tax deduction for contributions to college-savings plans but the rules vary. There is no minimum contribution. State tax benefits may not apply to K-12 tuition.

Missouri 529 Deduction Rules. Unfortunately the federal government does not allow families to deduct contributions to a 529 plan. 28 the state will allow taxpayers to deduct from their income a portion of contributions made not only to the states Missouri Higher Education.

The deduction limit for 529 plans currently sits at 8000 per year for single filers and 16000 per year for married couples filing jointly. 28 the state will allow taxpayers to deduct from their income a portion of contributions made not only to the states missouri higher education savings. The federal tax deduction rules for 529 plans are straightforward.

MO residents can claim a tax deduction for contributions to a MO 529 plan. 529 state tax deduction calculator. On the other hand in Missouri residents can contribute up to 8000 filing single and 16000 married filing jointly to a Missouri 529 Plan or another states 529.

See How You Could Pay Less Taxes Through Tax Deductions Tax-Free Withdrawals and More. K-12 tuition can be treated as a qualified education expense under the federal tax benefit. If your state has no income tax the 529 plan tax deduction doesnt apply.

This deduction is allowed for contributions to a 529 plan sponsored by any state not just Kansas. Tax Benefits of Missouris 529 Plan. Contributions are deductible in computing state taxable income 529 plan contributions grow tax-free.

State tax treatment of K-12 withdrawals is determined by the state where the taxpayer files state income tax. There is no indication that this rule will change anytime soon. You may move money by direct rollover money is transferred directly from your current 529 plan custodian to MOST 529 or by indirect rollover you request a check for the amount from the current 529 plan custodian and reinvest it in MOST 529 within 60 days.

Missouri taxpayers can deduct up to 8000 16000 if married filing jointly from their state taxable income annually. A state income tax deduction up to 8000 per year by an individual and up to. If youre not a Missouri taxpayer please consult with a tax advisor.

According to the Missouri Treasurers office there are more than 154500 active 529 plans in Missouri. Only the account owner can deduct their contributions to this 529 account. See How You Could Pay Less Taxes Through Tax Deductions Tax-Free Withdrawals and More.

Legal deductions are capped at 3000 per year for single filers and 6000 per year for joint filers. 52 rows 529 Deduction. Missouri offers a state tax deduction for contributions to a 529 plan both Missouri and non-Missouri of up to 8000 for single filers and 16000 for married filing jointly tax filers.

Illinois residents could deduct up to 10000 per child each year if state law is changed to allow it. Ad The Vanguard 529 College Savings Plan Could Help You Save Money on Taxes in The Long Term. Vanguard 529 state tax deduction calculator.

5000 single 10000 joint beneficiary. Though many states offer residents a state tax deduction for doing. 529 account contribution limits are generally highfrom 200000 to 300000 or more depending on the state.

Missouri taxpayers can use MOST 529 assets to pay for K-12 tuition at public private and religious institutions with no Missouri state tax consequences. The bill also provides joint filers with a maximum 16000 annual state tax deduction regardless of which spouse is contributing. The Missouri tax deduction for contributions to out-of-state 529 plans will be effective for 2008.

But regardless of your place of residence the earnings on your contributions will grow tax-deferred while theyre invested. Ad The Vanguard 529 College Savings Plan Could Help You Save Money on Taxes in The Long Term. Missouri residents can deduct from their state taxes up to 8000 per year for contributions to 529 plans.

Missouri will become the fifth state to adopt state tax parity for 529 deductions. If you live in Missouri and make a contribution to a MOST 529 Plan account then you can deduct the total MOST 529 Plan contributions for the year up to 8000 per person or 16000 if youre married filing jointly when you file your state income taxes. You may perform a tax-free rollover of a 529 account for the same beneficiary as often as once every 12 months.

Some states do have income taxes but no 529 plan tax deduction. Families should note that while the federal government does not reward 529 contributions it does penalize early withdrawals.

Tax Benefits Nest Advisor 529 College Savings Plan

What States Offer A Tax Deduction For 529 Plans Sootchy

How Much Can You Contribute To A 529 Plan In 2021

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

How Much Is Your State S 529 Plan Tax Deduction Really Worth

Which States Pay The Highest Taxes Family Money Saving Business Tax Economy Infographic

Most Missouri S 529 Education Plan Direct Sold Missouri 529 College Savings Plan Ratings Tax Benefits Fees And Performance

New Partnership To Help Employees With Disabilities Social Services Newspressnow Com Social Services Missouri State Companies Hiring

How Do I Choose A 529 Morningstar 529 College Savings Plan Saving For College How To Plan

529 Plan Deductions And Credits By State Julie Jason

Does Your State Offer A 529 Plan Contribution Tax Deduction

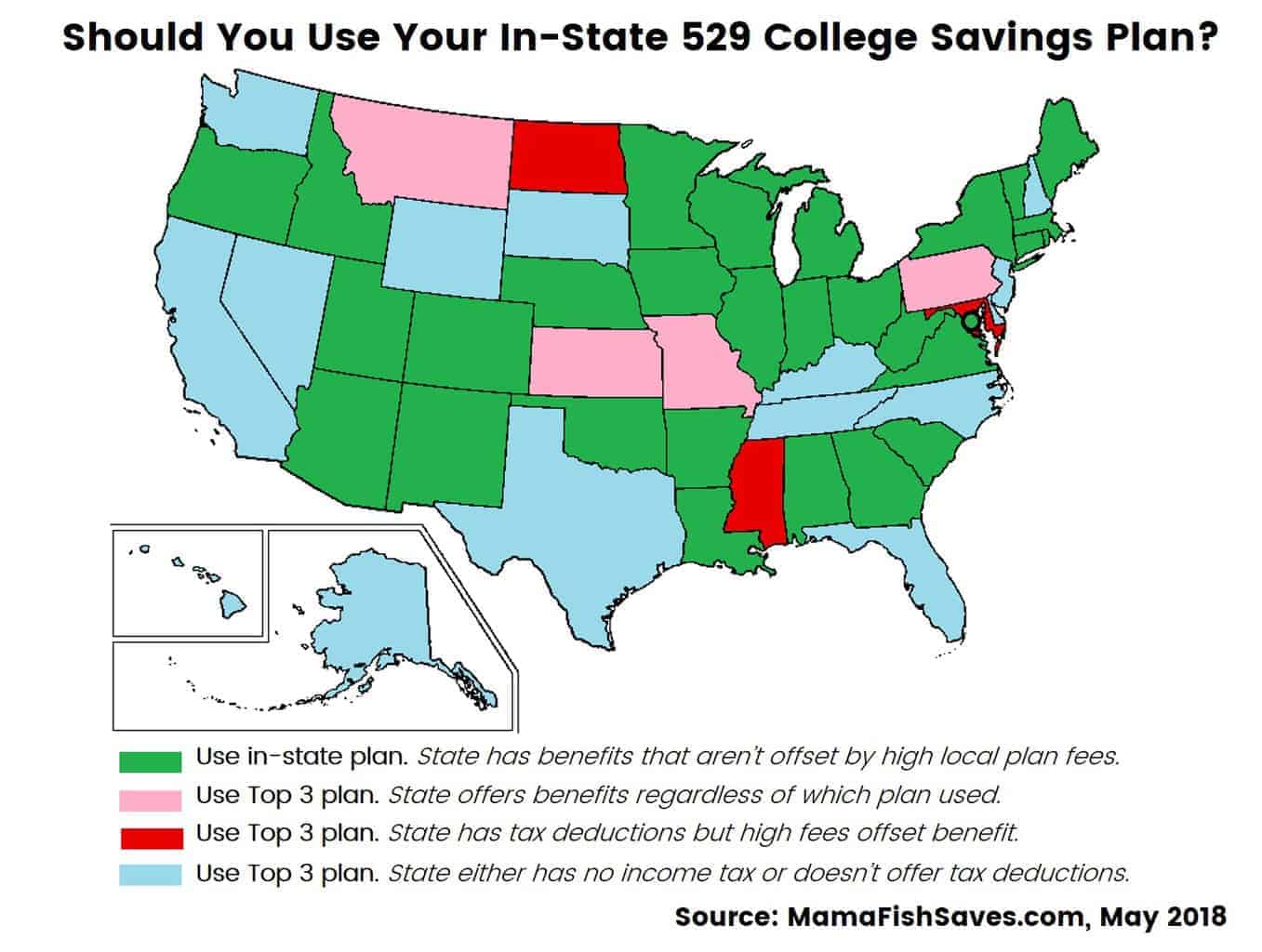

Choosing The Best 529 College Savings Plan For Your Family Smart Money Mamas

529 Plans Which States Reward College Savers Adviser Investments

Arizona 529 Plans Learn The Basics Get 30 Free For College Savings

Leaf Guide To 529 Plans Leaf College Savings Benefits Portal

Tax Benefits Nest Advisor 529 College Savings Plan

Post a Comment for "Missouri 529 Tax Deduction"